How To Pay Investa Services To Clear My Fifa Tax Lien

Recently, we accept seen more judicial taxation sales in Georgia. This type of sale is much different than a non-judicial tax auction. OCGA § 48-four-75. Both the procedures and the deadlines differ.

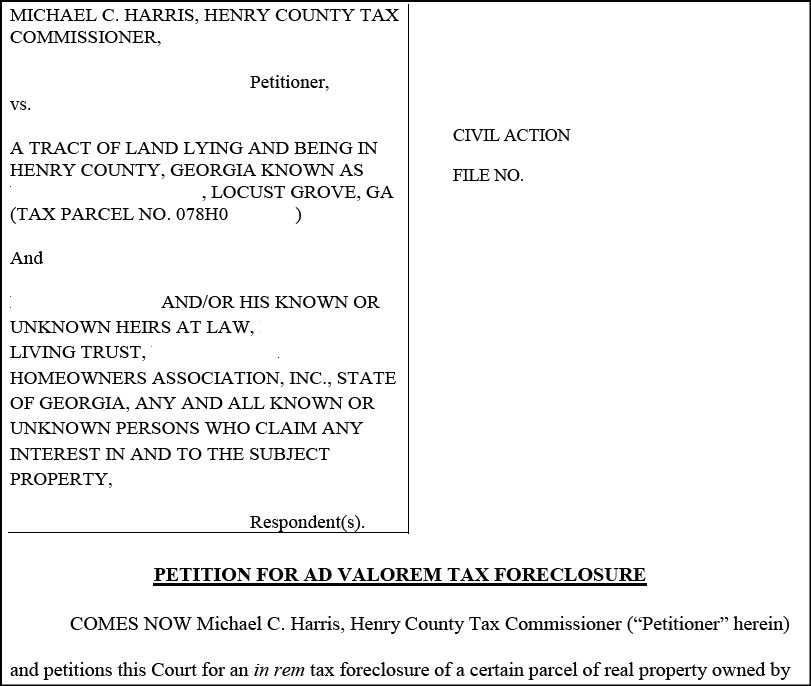

When a taxpayer fails to property taxes, a county may file a judicial-in-rem tax sale. OCGA § 48-4-78. When the county employs this blazon of taxation sale, it files a "Petition" in the superior courtroom. The Petition is against the holding itself and anyone with an interest in the property, including the owner.

Once the county files the Petition, the canton gives notice to the interested parties. OCGA § 48-four-78. The county posts the property with copies of the summons and Petition, notice to interested parties, and find of hearing. The county also sends the documents by regular and certified mail to all interested parties. Lastly, the canton publishes a legal notice in the county newspaper alerting the public. The discover runs for two weeks).

Post-obit discover, the court holds a hearing. Any interested political party has the correct to be heard and to contest the allegations in the Petition at the hearing. If the superior court determines that the information in the Petition is accurate and that the county gave proper find, the court volition order the county to sell the property at an auction. OCGA § 48-iv-79.

The county then advertises the auction of the property in the county's legal newspaper for four weeks. The advertisement volition show the possessor's proper name, a description of the property to be sold, and the amount of the taxation due OCGA §§ 9-thirteen-140-142.

Before judicial tax sale auction, an interested party may redeem the belongings past paying the redemption corporeality to the canton tax commissioner. If an interested party pays the redemption amount, the county dismisses the Petition. OCGA § 48-4-80.

One of the main differences between judicial and non-judicial tax sales is that a judicial taxation auction allows only 60 days to redeem (purchase dorsum the belongings). In a non-judicial revenue enhancement sale, the owner has at least ane year to redeem. OCGA § 48-4-81.

The other major difference is judicial tax sales vest championship admittedly into the purchaser. In theory, this eliminates the need for post-auction barment procedures and repose title actions. At that place is piddling example police to provide guidance, but we expect the courts to consider these bug in the future.

At Gomez & Golomb, we regularly file quiet title actions. Whether you lot're trying to get marketable championship following a taxation sale or trying to clear up a clouded title, the post-obit is a quick overview of the requirement to file a placidity title in Georgia:

(1) The filing party must own/hold title.

(2) At that place must be a cloud against the filing party's championship.

(3) For conventional tranquillity titles, the activeness must exist filed in the Superior Court in the canton where the adverse party lives. OCGA § 23-3-twoscore.

(4) For quiet titles against all the earth, the action must be filed in the Superior Court in the canton where the land is located. OCGA § 23-3-60.

(5) The repose title must exist verified (signed under oath) by the filing party.

(6) The tranquillity title must include a description of the holding, a description of the filing party's involvement in the belongings, any adverse claims on the belongings, a plat of survey, and a lis pendens.

(vii) In a quiet title against all the globe, the petition must exist submitted to a special principal, who examines the championship, determines the interested parties, ensures the interested parties are served, holds a hearing, and issues recommendations to the court.

(viii) All agin parties who are known and whose residences are ascertainable by the sheriff or his deputy must exist served; the filing party must make a diligent effort to place and serve the agin parties.

(ix) Service by publication is permitted when the adverse party resides out of the state or if the residence is unknown.

If you have any questions, please phone call us at 404-392-9994.

A new Georgia appellate case, Moxie Capital v. Delmont 21 (2021), has been released that every taxation human activity purchaser, investor, and property possessor should know well-nigh. The instance involves how to redeem a property following a tax sale.

OCGA § 48-4-forty says the holding possessor or an interest holder in the property may redeem a property following a tax sale. Redemption must occur within a twelve-calendar month window and later on a notice of right to redeem has been provided. OCGA § 48-4-42 states how much a redeeming party must pay to redeem. Importantly, the funds required to redeem "shall be paid in lawful coin of the The states."

In Moxie Capital, an investor attempted to redeem a property. For various reasons, the attempted redemption occurred on the concluding day of the redemption flow. The investor contacted the tax deed holder for a payoff. There were conflicting versions of what happened from there. The investor said the tax human activity holder did non cooperate; while the tax human activity holder argued he had no obligation to cooperate.

What the parties don't dispute is that the investor timely delivered a personal check to the tax deed holder. The investor claimed that certified funds were not available considering the banks had closed by the time he found out the details of where to evangelize the redemption amount. On the next day, the tax deed holder returned the personal check to the investor. And claimed that the investor'southward right to redeem had expired.

Naturally, this went to court. While somewhat complicated, ultimately, the investor lost. And the tax human activity purchaser got the property. The Georgia Court of Appeals ruled that to redeem, funds must be in the form of greenbacks or certified check. The Court cited OCGA § 48-four-42, which says funds must be "paid in lawful money of the United States." Although no Georgia courtroom has clearly defined "lawful money," the Georgia Courtroom of Appeals reasoned that a personal check is a promise to pay. Thus, the Court of Appeals did not consider the investor'due south personal check to be a payment.

The Courtroom of Appeals besides suggested that a tax human activity purchaser has no obligation to human action in "good organized religion" when responding to a party trying to redeem.

Moxie Capital is consistent with other Georgia cases that use redemption statutes strictly. Some would say harshly. Whether y'all agree or disagree with the issue will depend on which side of the ledger you're on.

Regardless of if you are a tax act purchaser or a homeowner, we will be glad to represent you lot to get you through the process safely.

Belongings taxes in Georgia are due towards the end of the year. For example, in Fulton Canton, 2021 taxes were due by Nov fifteen, 2021. When property taxes are non paid, the county'south taxing dominance issues a fifa. A fifa acts as a lien against the property and is recorded on the county's real manor records. The taxing authority must issue a xxx-day notice to property owners before filing the fifa. The lien remains on the county'due south public records until the taxpayer pays the taxes.

The well-nigh dramatic event that happens afterward filing a fifa is that the taxing potency may nowadays the tax lien to the sheriff. The sheriff will employ the fifa as a basis to sale the property to pay the taxes. This process is known as a tax sale.

To become taxes paid, taxing authorities in Georgia often sell their fifa'south to tertiary-party investors. FIG and Investa are two companies that purchase tax liens.

For a taxpayer, a transfer of a tax fifa is confusing because the third party pays the county. The taxes are then owed to third-party, not the county. Thus, the county will testify the taxes as paid, but the taxes are notwithstanding owed.

Under Georgia law, OCGA § 48-iii-nineteen, the 3rd-party purchasing the lien must send observe by first-class post to the taxpayer within lx days. In theory, this is to notify the taxpayer of whom to pay the taxes to. Nevertheless, our role has had reports from taxpayers claiming they didn't go any find. Like the taxing say-so, the third political party can take the fifa to the sheriff and ask to auction the property to pay off the fifa.

If taxes are unpaid, you need to act equally chop-chop equally possible to pay the taxes to the right party earlier there is a taxation auction. Please call us at 404-382-9994 if y'all find yourself in this situation.

OCGA § 48-four-42 says: "The amount required to be paid for redemption of property from any sale for taxes . . . shall . . . exist the amount paid for the property at the tax sale . . . plus a premium of xx percent of the amount for the starting time year or fraction of a year which has elapsed between the date of the auction and the date on which the redemption payment is made and 10 percent for each year or fraction of a year thereafter."

OCGA § 48-4-xl says the taxation human activity purchaser may terminate the right to redeem one year after the tax auction by sending out notices to any interested parties. The find regarding the taxation deed must include a deadline to redeem.

It sounds elementary enough, but what if the parties can't agree on an amount? And what if a party redeems inside the borderline by mistakenly pays less than the full redemption corporeality required under the statute? This state of affairs arose in D&D Family Backdrop, LLC v. Wright, A20A1339 (November 3, 2020).

In Wright, the tax sale took identify on July 5, 2017. The Court of Appeals establish that the borderline starts running on the date of the taxation sale. Thus, the borderline to redeem fell on July 4 of the following year. The redeeming political party submitted $seven,600 on July 5 ($6,000 for the amount paid at the tax sale plus the 20% premium). It did this thinking the one-twelvemonth deadline ran on July 5. Or because July four was a vacation, the deadline rolled over to the next business organization twenty-four hour period.

The Court of Appeals disagreed. It ruled that by July 5, the redeeming party owed an additional 10%. Thus, the $seven,600 was inadequate, and the redeeming party could not redeem.

The takeaway is the Court of Appeals is willing to strictly enforce the statutes regarding tax sales.

How To Pay Investa Services To Clear My Fifa Tax Lien,

Source: https://gandglegal.com/category/tax-sales/

Posted by: shoemakerwarl1992.blogspot.com

0 Response to "How To Pay Investa Services To Clear My Fifa Tax Lien"

Post a Comment